Data: Movies account for 48% of US streaming revenue

October 17, 2025

A Parrot Analytics analysis of thousands of titles across Prime Video, Disney+, Netflix and HBO Max in the US finds that movies deliver disproportionately high engagement relative to the volume of content hours they represent.

The recent narrative has been that movies, in contrast to TV series, were in decline – casualties of a once-in-a-century pandemic that shuttered theatres and a double blow from prolonged industry strikes, suggests Parrot Analytics. But there’s data that paints a different picture. In the constant battle against churn, movies are proving to be one of the most efficient tools streamers have to keep viewers coming back.

Parrot Analytics analysed thousands of titles – both series and films – across Prime Video, Disney+, Netflix and HBO Max. Using its demand and engagement data, it then calculated how each title contributed to actual revenue in the US market. Parrot Analytics built ‘lookalike’ audiences to model both current and prospective subscribers and trained those models against reported revenues. This allowed the company to estimate each title’s contribution to acquisition and retention – and to attribute total revenue between TV and film content.

The results:

-

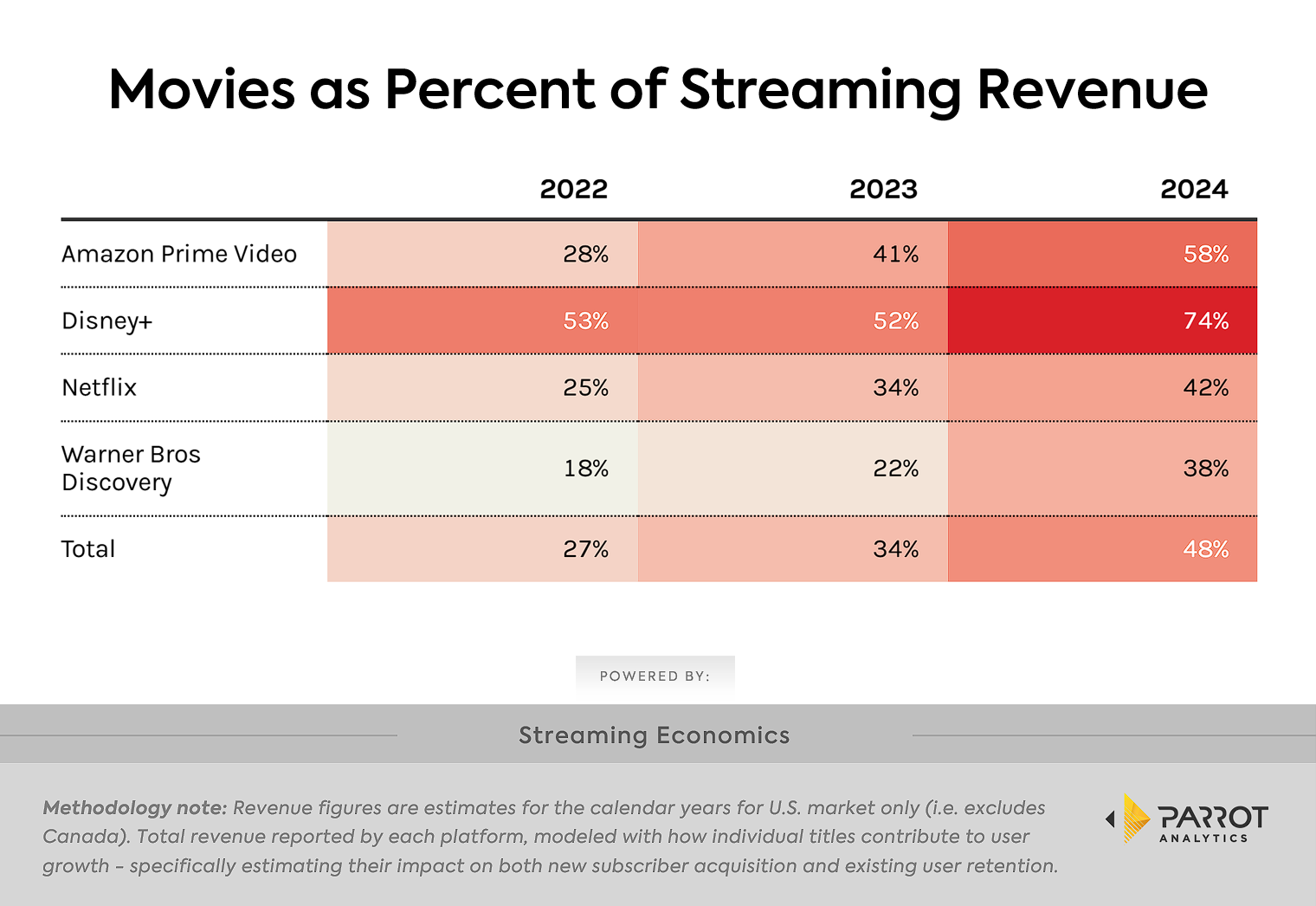

In 2022, movies represented roughly 27 per cent of total streaming revenues.

-

By 2024, that share had climbed to nearly 50 per cent.

-

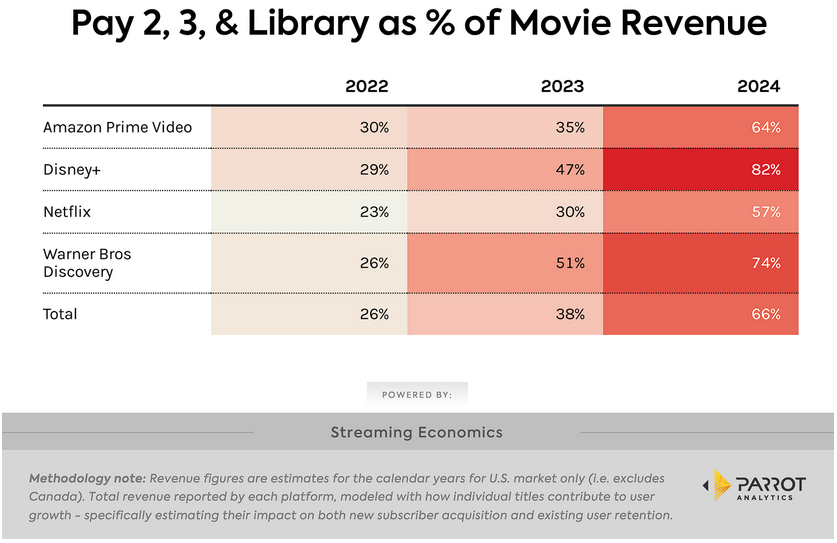

Within movie-driven revenue, Pay-2/3 and library windows now account for about two-thirds of total movie value, up from just 26 per cent in 2022.

These numbers align with what is seen in Netflix’s own engagement reports – older films from as far back as 2020 continue to generate meaningful viewership. Movies consistently punch above their weight, delivering disproportionately high engagement relative to the volume of content hours they represent.

Parrot Analytics suggests there are several reason why this trend is happening now:

1. The Churn Factor

As streaming markets mature, churn management becomes mission-critical. Netflix’s Co-CEO, Ted Sarandos has repeatedly emphasised that their film library is where “members go to watch their weekend movie.” That habit creation – and the emotional comfort it provides – translates directly into lower churn and higher lifetime value.

2. The Profitability Pivot

Wall Street’s mandate for profitability has forced platforms to scrutinise development pipelines and optimise ROI. Licensing third-party films – particularly those in later pay windows – offers more predictable economics and higher margins than producing new, untested series. As HBO’s Casey Bloys noted early this year in an interview with Puck; the company is now focusing on the content its subscribers actually watch – which increasingly includes Pay-1 films.

3. The Supply-Side Shift

Film distributors are also evolving. As theatrical windows narrow and global streaming demand expands, producers are finding new ways to monetise catalogue and genre-driven content. Jeff Sackman and Berry Meyerowitz of Quiver Distribution note that movies continue to play “a critical role in the premium streaming landscape,” with genre diversity and talent driving engagement across PVoD, TVoD, Pay-1 and library windows.

What’s Next?

This resurgence of movies as a streaming retention tool offers a interesting blueprint for what’s next, states Parrot Analytics. We’re now seeing sports emerge as the next great frontier – offering live engagement and ad-monetisation potential that films can’t match. But the economics are far more complex: sports rights are concentrated, expensive, and often yield tighter margins. If movies are streaming’s quietly dependable workhorses – as Parrot advisor Larry Aidem has put it – ‘TV series monopolise attention and marketing budgets and far too often seem like independent films without editors”- sports may become its high-stakes experiments.

“The key for platforms will be to find the right balance, combining the dependability of film libraries with the cultural heat of live events. At Parrot Analytics, we see this evolution not as the decline of any format, but as a rebalancing of the entertainment industry guided by the attention economy, one where films are once again proving indispensable,” concluded the report.

Other posts by :

- Bank: SES outperforming

- AST SpaceMobile confirms 2026 launch schedule

- AST SpaceMobile: “Good for indoor reception”

- EchoStar booms on SpaceX holding

- Norway wants a satellite constellation

- Crossroads backs AST SpaceMobile

- FCC examines SpaceX’s 15,000 sat-constellation plan

- EchoStar: “Severe uncertainty” led to spectrum sales

- Netflix gets downgrade on Warner Bros move