Data: SVoD programming shrinks in Q4; Sports content rises

November 25, 2025

Gracenote has updated its Data Hub with Q4 2025 data. Key highlights from the new release include a decrease in total SVoD programming compared to the previous quarter, and an uptick in sports content across both SVoD and FAST platforms.

Q4 2025 Data Hub Update Highlights

SVoD

Video distribution across five global SVoD providers (Apple TV, Prime Video, Netflix, Paramount+, Disney+):

-

The increase in total programming in Q4 was notably lower than in Q3

-

105.2k unique programmes (excludes individual episodes) [+2.3 per cent since Q3]

-

662.3k total programmes [2.7 per cent increase since Q3]

-

In Q3, the increase at the programme level (excluding episodes) was 9.7 per cent

Video distribution across the five major SVoD providers

-

Prime Video maintains stance as largest distribution: 69 per cent of total

-

TV, movie distribution percentages are flat from Q3

-

-

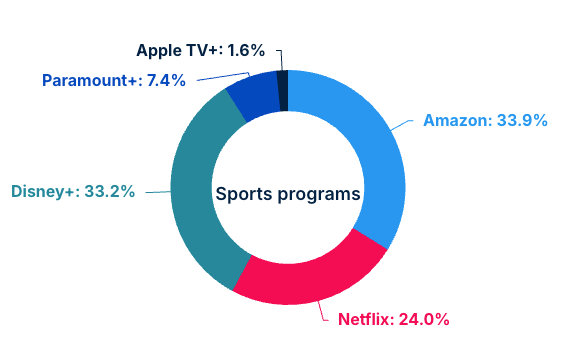

Sports programming increased 9.3 per cent across these five providers

-

Total sports programming (including individual games and competitions) is just under 18k (+10 per cent since Q3)

-

Disney+ grew its sports programming by 29 per cent since Q3 to account for 33.2 per cent of the five providers, just 0.7 per cent behind Prime Video

-

-

The amount of exclusive programming on Paramount+ has declined nearly 8 per cent since Q1 2025. Also, Paramount+ has the lowest percentage of exclusive content across the 5 providers at 60 per cent.

-

Drama remains the most prevalent genre (just under 25 per cent of programmes have a drama genre)

-

Tense remains the most prevalent mood (more than 36 per cent of programmes have a tense mood)

-

The amount of pre-1990 content across all five providers in 2025 is up 21.5 per cent

-

The amount of content produced from 2020 onward across all five providers in 2025 is up 25.4 per cent in 2025

FAST

FAST channel growth

-

Total No. of channels: 2,012 [+8.9 per cent since Q3]

-

29.1 per cent increase in FAST channels in Canada since Q3. Canada is now the fourth largest FAST channel market based on GN Global Video Data (only three fewer than Germany)

-

12.4 per cent increase in FAST channels in Germany

-

6.5 per cent increase in FAST channels in the UK

-

5.9 per cent increase in FAST channels in the US

-

Programming on FAST channels

-

Total of 35.3k unique programmes (excludes individual episodes) [+3.7 per cent since Q3]

-

Total of 201.7k total volume of programmes [+2.3 per cent since Q3]

-

The increase in sports on FAST dramatically outpaced the increase on SVoD

-

20.4 per cent increase in sports programming from Q3->Q4 at the individual episode/competition level [17.5 per cent increase at the series ID/programme level].

-

-

12.8 per cent increase in programmes with an action genre; 13.7 per cent increase in programmes with a horror genre; 14.3 per cent increase in programmes with a nature genre

-

8 per cent decrease in programmes with a romance genre; 4.5 per cent decrease in programmes with a western genre

Other posts by :

- Inmarsat “likely to win appeal” over Ligado/AST action

- FCC seeks fair play over foreign satellite access

- Bank raises RocketLab target price

- Ukraine wants its own LEO system

- SpaceX outlines Starlink cellular delivery plan

- NAB vs CTIA on C-band release

- Laser terminals to operate at 100x faster

- Starlink success in Spain, but South Africa proves difficult