Research: Live rights reducing churn for streamers

October 14, 2025

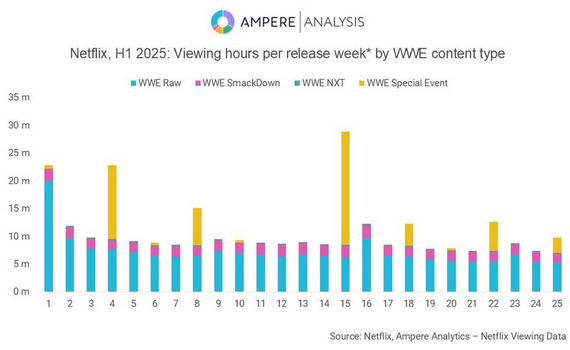

WWE content amassed over 300 million viewing hours on Netflix in H1 2025. following its January debut on the streaming platform, reports Ampere Analysis.

Weekly flagship show WWE Raw has proven to be the biggest draw, building a consistent live audience that averaged 6.5 million viewing hours per broadcast. And Premium Live Event, WrestleMania 41, delivered 19.8 million viewing hours across its April double bill.

According to Ampere Analysis, streamers are accelerating investment in exclusive live rights to drive habit and reduce churn: the annual value of sports rights held by subscription OTT services has risen from $3.2 billion (€2.7bn) in 2020 to $12.3 billion in 2025.

Key findings:

- Top-tier ‘season’ performance: Treating WWE Raw as an episodic ‘season’, it generated 88.6 million total views (defined as viewing hours per hour of content) in H1 2025 — third among all TV seasons. This is an impressive feat as it was available in only 12 markets covering ~52 per cent of Netflix subscribers. In comparison, first- and second-placed seasons of Adolescence and Squid Game were available globally.

- Consistent weekly audience: After a heavily promoted premiere, WWE Raw has evolved into a consistent weekly average audience of 6.5 million viewing hours per broadcast. SmackDown and NXT add a further 2.2 million hours per week. This consistent viewing is punctuated with special events such as WrestleMania 41 which received 19.8 million viewing hours across its weekend double bill in April.

- Lower churn vs one-off live sporting events: Among US users who signed up for the Raw premiere, 18.2 per cent churned after 60 days, outperforming comparable Netflix live events such as Jake Paul vs Tyson (25.6 per cent) and the NFL Christmas game day (27.2 per cent).

- Fans drive subscriber growth: Ampere’s consumer survey shows US WWE viewers with a Netflix subscription growing from 62 per cent in Q3 2024 to 76 per cent in Q1 2025 (vs 59 per cent and 61 per cent across all respondents).

- Sports rights momentum: As streamers increase investment in sports broadcasting, and live appointment viewing, the annual value of sports rights held by subscription OTT services has risen from $3.2 billion in 2020 to well over $12 billion in 2025.

- Global expansion opportunity for Netflix and WWE: Multiple countries offer the streamer similar engagement for the WWE to that of the US (17.4 per cent). These include South Africa (27.6 per cent), the Philippines (22.6 per cent) and India (25.5 per cent). As Netflix does not yet carry WWE here, there is further growth potential if rights expand.

Joshua Rustage, Senior Analyst at Ampere Analysis, commented:: “WWE Raw’s weekly broadcast is building a loyal, regular viewership – perfect for helping Netflix reduce churn versus one-off major events. The US experience with WWE underscores why the streaming platforms are investing in premium, recurring live sports rights.”

Other posts by :

- AST SpaceMobile’s BlueBird/FM1 enroute to India

- D2D satellite battle hots up

- Eutelsat share price rockets

- AST SpaceMobile recovers after Verizon agreement

- Bank has mixed messages for AST SpaceMobile

- EchoStar clears key regulatory hurdles for Starlink deal

- Starlinks falling to Earth every day

- 650 Starlink D2C craft in orbit

- Bank upgrades SES to ‘Buy’