Survey: 78% of Gen Z say TikTok influences their spending

August 26, 2025

Despite economic pressures, lifestyle spending remains a core part of UK consumer behaviour. While nearly a quarter of adults find it difficult to get by financially, emerging data suggests that Brits still want to spend money to fuel their lifestyle.

A study by Aqua reveals that 80 per cent of Brits agree that their lifestyle spending reflects their personal values or identity. The study, which surveyed 2,000 UK adults, also uncovers the nation’s lifestyle spending habits, the powerful role of social media in driving financial decisions, and how many of these purchases ultimately lead to regret.

Eating out tops the list of lifestyle spending categories

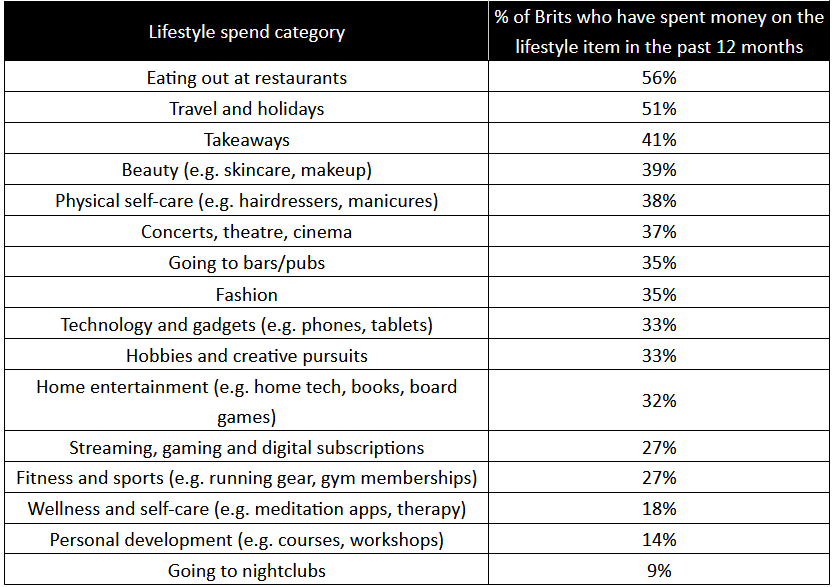

At the top of the list is eating out at restaurants, with 56 per cent of Brits spending money in this category over the past 12 months. This is closely followed by travel and holidays (51 per cent), suggesting that despite ongoing economic pressures, dining experiences and time away remain central to the way Brits choose to reward themselves.

Takeaways (41 per cent) and beauty (39 per cent) also rank highly, reflecting a growing appetite for convenience and self-care, while physical self-care services (38 per cent), such as hairdressers and manicures, further suggest the importance placed on personal presentation and wellness.

Brits are spending close to £600 per month on entertainment and leisure

Entertainment and leisure commands the greatest share of overall monthly spending. Brits invest an average of £581 per month on this category, which includes streaming services, concerts, hobbies, and home entertainment.

Personal growth and wellness (which includes things such as fitness, upskilling courses and therapy) follows as the second-largest spending category, with an average monthly spend of £494, reflecting a growing national focus on self-improvement and wellbeing. Close behind is travel, underscoring its continued importance in people’s lives.

Fashion and beauty sees a monthly average spend of £399, surpassing food and drink (£251) and technology (£246), indicating that personal style and aesthetics are still high on the priority list, even amid rising costs.

Interestingly, despite the popularity of eating out and social occasions, food and drink ranks fifth among the categories, suggesting that while frequent, these costs are generally lower-ticket compared to more identity-driven or aspirational spending areas.

Spending patterns vary notably across the UK. Men spend £309 more on fashion each month than women, while 25–34-year-olds are the biggest travellers, averaging £650 on holidays. Although most cities favour travel, Londoners prioritise fashion (£555), Manchester tops tech spending (£808), Sheffield leads nightlife spend (£863), and Southampton focuses on personal development (£470) above anything else.

“The data paints a clear picture of where the real financial pressures lie in 2025,” said Sharvan Selvam, Commercial Director at Aqua. “While categories like travel and entertainment remain popular, it’s lifestyle-led spending on fashion, tech, and personal development that’s quietly eating up the biggest share of monthly budgets. For households trying to manage their budgets, understanding where the largest chunks of money are really going is the first step to taking back control of their spending.”

70% of Brits admit social media has influenced their spending

More than 70 per cent of adults admit that social media has influenced their lifestyle spending, demonstrating the impact digital platforms have in driving purchasing decisions.

Facebook (49 per cent) emerges as the single most influential platform, followed closely by Instagram (47 per cent) and TikTok (42 per cent), revealing a clear dominance of visually led, trend-driven content is what fuels spending habits. Meanwhile, YouTube (37 per cent) continues to hold a strong position in product discovery and research, while platforms like X (14 per cent), Pinterest (12 per cent) and Snapchat (9 per cent) seemingly influences more niche audiences.

Facebook drives spending for over 35’s, but unsurprisingly, TikTok dominates Gen Z, with 78 per cent of 16 to 24-year-olds saying they’ve been influenced to shop by what they see on the platform. Among those aged 25 to 34, Instagram takes the lead, swaying 61 per cent of this age group.

However, this influence comes at a cost. Some 61 per cent of adult Brits, an estimated 34 million people, admit they’ve regretted purchases made as a result of social media, trends, or peer pressure. This figure highlights the emotional and financial fallout of lifestyle spending, where the desire to keep up with online trends often outweighs practical considerations such as value or long-term usage.

“Social media helps people discover new products and services,” added Sharvan, “but it can also lead to more reactive spending, especially as the platforms are making shopping within the app even more accessible, such as the growing popularity of TikTok Shop. The key is being aware of this influence, so you can make financial choices that feel considered rather than impulsive.”

Other posts by :

- SES announces €0.25c dividend

- Bank: AST, Starlink, Kuiper targeting $200bn market

- Rivada: Is no news good news?

- SES celebrates Intelsat acquisition

- Pakistan halts broadband direct-from satellite

- India stymies Starlink launch

- Starlink, AST SpaceMobile race for cellular consumers

- Trouble ahoy for foreign D2D satellites over India?

- Can Starlink disrupt the US Cellular sector?