Report: Brazil emerges as streaming powerhouse

May 28, 2025

Brazil is currently Netflix’s second largest market worldwide in terms of subscribers, and soon to be the second biggest international market for FAST services, according to Omdia.

Brazil has established itself as a powerhouse in the global streaming landscape, with significant achievements in both subscription-based and free ad-supported streaming television sectors said Maria Rua Aguete, Head of Media and Entertainment at Omdia, speaking at The Samsung Summit during RIO2C event in Brazil.

Netflix Dominance and FAST Growth

Brazil ranks as Netflix’s second-largest market worldwide with 20.6 million subscribers, behind only the US. Netflix holds a commanding 30 per cent share of Brazil’s online video subscription market, followed by Prime Video (14 per cent) and local powerhouse Globoplay (10 per cent).

“Brazil’s relevance and leadership across both paid and free streaming ecosystems is truly remarkable,” stated Rua Aguete during her presentation. “As Netflix’s second-largest subscriber base globally with 20.6 million users, and projected to become the world’s third-largest FAST market by 2029 behind only the USA and UK, Brazil represents the perfect case study of a market embracing the full spectrum of streaming options.”

Brazil is positioned to become the second-largest international FAST market by 2029, with projected revenue of $303 million, behind only the UK ($488 million) among international markets.

Dual-Model Success

“What’s particularly impressive is how Brazilian viewers are adopting both premium subscription services and ad-supported models simultaneously, creating a diverse and thriving digital entertainment landscape that content providers simply cannot ignore,” Rua Aguete emphasised.

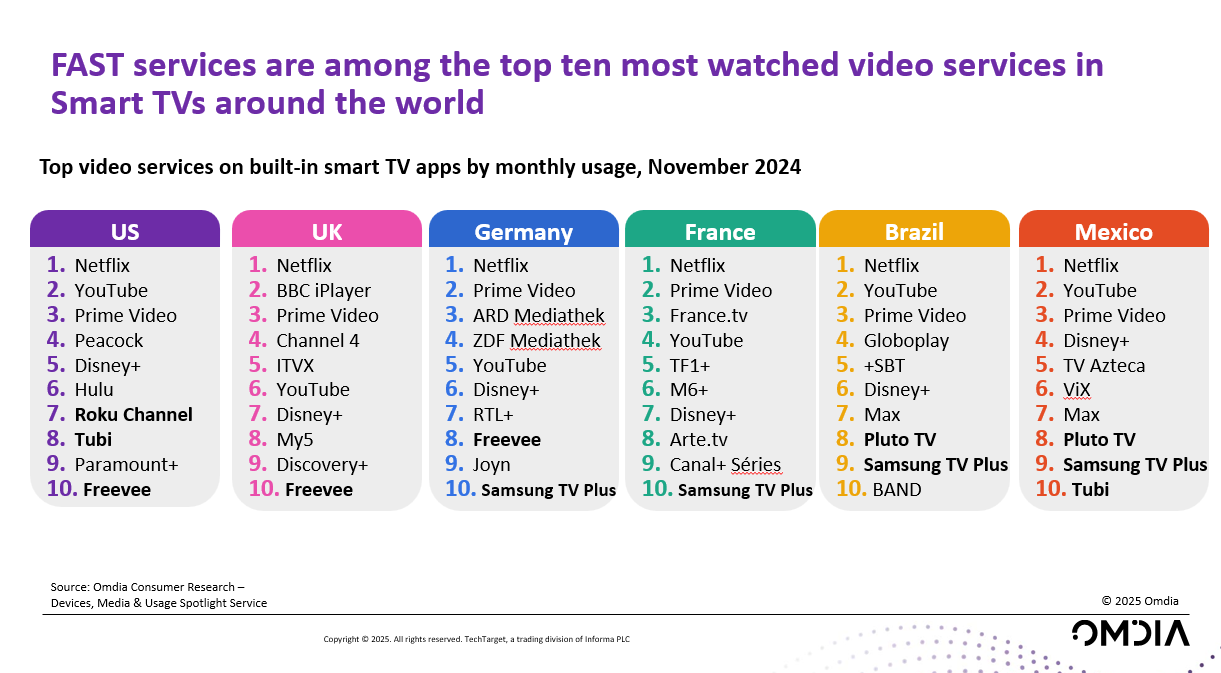

FAST services such as Pluto TV and Samsung TV Plus have broken into the top 10 most-used Smart TV services in Brazil, with 75 per cent of FAST users preferring live channels and nearly 80 per cent accessing content via connected TV devices.

Economic Impact

This streaming boom is reshaping Brazil’s media economy. Online video spending is projected to reach $14.4 billion (€12.7bn) by 2029 from $9.9 billion in 2025. Brazilian content is also finding global success, with titles like “Desperate Lies,” “Burning Betrayal,” and “Senna” ranking among Netflix’s top international exports according to data from PlumReserach.

According to Rua Aguete, this success stems from Brazil’s unique storytelling approach that emphasizes local identity and emotional resonance while maintaining universal appeal.

Other posts by :

- Bank: “Charter racing to the bottom”

- SpaceX IPO in June?

- Russia postpones Starlink rival

- Viasat taps Ex-Im Bank to finance satellite

- Bank: TeraWave not a direct threat to AST SpaceMobile

- SpaceX lines up banks for IPO

- SES to FCC: “Don’t auction more than 160 MHz of C-band”

- Morgan Stanley downgrades Iridium