Data: US watched over 103bn minutes of TV on Thanksgiving

December 17, 2025

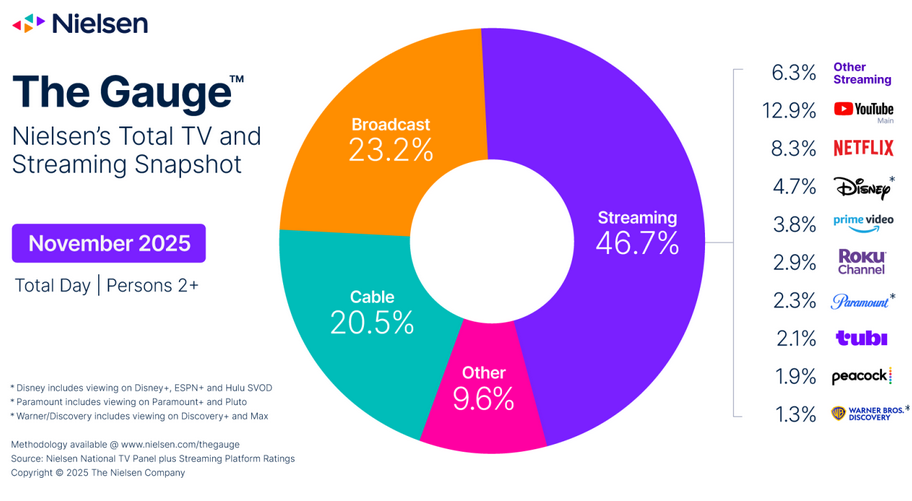

November 2025 delivered what Nielsen has described as “one of the most historic months to date” in its report of The Gauge, the monthly snapshot of total TV and streaming consumption in the US.

The five-week reporting interval produced a 5.5 per cent monthly increase in television usage, with live sports driving broadcast to its best share of TV since November 2024, while simultaneously fueoling double-digit growth for hybrid streamers like Peacock and Paramount+.

Thanksgiving Day is the centerpiece of November television viewing, and this year was no exception, as audiences watched 103.4 billion minutes of TV across the day and highlighted the various viewing behavior trends. Linear streaming on Thanksgiving represented 10.1 per cent of total TV usage to achieve the second-highest level of daily linear streaming ever, surpassed only by Super Bowl Sunday in February 2025. By comparison, linear streaming totaled 7.8 per cent of TV usage across the month. Additionally, Thanksgiving was the broadcast category’s 10th-most-watched day since the inception of The Gauge in May 2021.

Broadcast extended its momentum in November, with viewership increasing 7 per cent versus October to capture 23.2 per cent of TV and outpace cable for a third consecutive month. Broadcast gains were driven by a 30 per cent monthly increase in sports viewing, specifically from the back-half of the MLB World Series on Fox, plus NFL and college football on ABC, CBS, FOX and NBC. And despite accounting for just 3 per cent of broadcast content by duration, sports commanded 37 per cent of all broadcast viewership in November and 6.4 per cent of total TV usage – the highest share for the genre ever recorded in The Gauge. NFL coverage drew more younger audiences into the broadcast ecosystem as well, with viewing for the under-30 group up 21 per cent this month, and viewing for kids 2-11 up 27 per cent.

The sports effect was just as potent in streaming, as multi-platform distributors continued to demonstrate how live sports are fuelling a unified viewership ecosystem:

- Peacock posted the strongest monthly growth among streaming platforms in November, soaring 22 per cent on the strength of its NFL Sunday Night Football coverage and Thanksgiving Day programming. Peacock’s Thanksgiving featured simulcasts of NBC’s Macy’s Thanksgiving Day Parade and a primetime NFL game, the platform averaged 2.4 million viewers across the day, trailing only YouTube and Netflix (compared to individual platform totals). Peacock also benefited from new original drama series All Her Fault, which generated 2.4 billion minutes. The overall impact lifted Peacock to a non-Olympic record 1.9 per cent share of television (+0.3 pts.).

- Paramount+ (within Paramount Streaming) jumped 18.4 per cent month over month, driven by NFL games alongside the return of its original series Landman. These gains lifted the combined Paramount Streaming portfolio to a 2.3 per cent share of television (+0.2 pts.).

In addition to live sports, November also exhibited a striking example of broadcast and streaming convergence. The Thanksgiving Day NFL matchup between the Chiefs and Cowboys on CBS generated 11.7 billion viewing minutes and was the top broadcast telecast of the month. Meanwhile, Stranger Things on Netflix totaled 11.8 billion viewing minutes across the entire month. Despite being viewed live versus on-demand, the end results were nearly identical as each accounted for more than 22,000 years of cumulative television viewing by US audiences.

Overall, streaming usage grew 8 per cent in November and captured 46.7 per cent of total TV watch-time. This month also featured five of the top ten most-streamed days ever recorded, led by November 29th, which now ranks second all-time with 47.6 billion minutes streamed, behind the 51 billion minutes clocked on Christmas Day 2024. Most impactful to the overall November streaming landscape, however, was Netflix’s Stranger Things, whose nearly 12 billion viewing minutes propelled Netflix to a 10 per cent monthly increase, adding 0.3 share points to finish with 8.3 per cent of total TV. The Roku Channel also posted a standout performance, rising 9 per cent overall and benefiting from a 23 per cent jump among viewers ages 25–34. The gains lifted the platform to a record 2.9 per cent share of television.

Meanwhile, cable usage dipped 3 per cent to a 20.5 per cent share, exhibiting its lowest monthly total to date. While NFL games on ESPN remained top performers, the category felt the absence of the MLB playoffs, which caused the cable sports genre to retract by 42 per cent. The category was buoyed slightly by holiday spirit, however, as the cable movie genre saw a 22 per cent increase in viewership.

Other posts by :

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”

- Russia accused of eavesdropping on satellites