Report: Global retail media ad market nears $200bn

November 4, 2025

The global retail media market retains significant momentum, with ad investment projected to surpass $200 billion (€173.8bn) by 2027, reports WARC Media. However, underlying this growth is an evolving industry. As brands consolidate their ad spend across fewer retail media networks and sponsored search growth slows, retailers must reinvent themselves as ‘full-funnel’ platforms offering granular display and off-site solutions, whilst preparing for the impacts of agentic commerce and AI.

Alex Brownsell, Head of Content, WARC Media, commented: “Retail media has evolved from a US and China-driven trend into a global phenomenon, with European spend now growing at double the rate of the broader digital advertising market. As the sector expands beyond traditional sponsored search into visual display, audio, social and television partnerships, it has never been more important for advertisers to have clarity on the scale and the suitability of the commerce media opportunity.”

The Future of Commerce Media 2025 examines key trends, ad investment and the impact of AI that will drive the future of retail media

Retail Media ad market nears $200bn

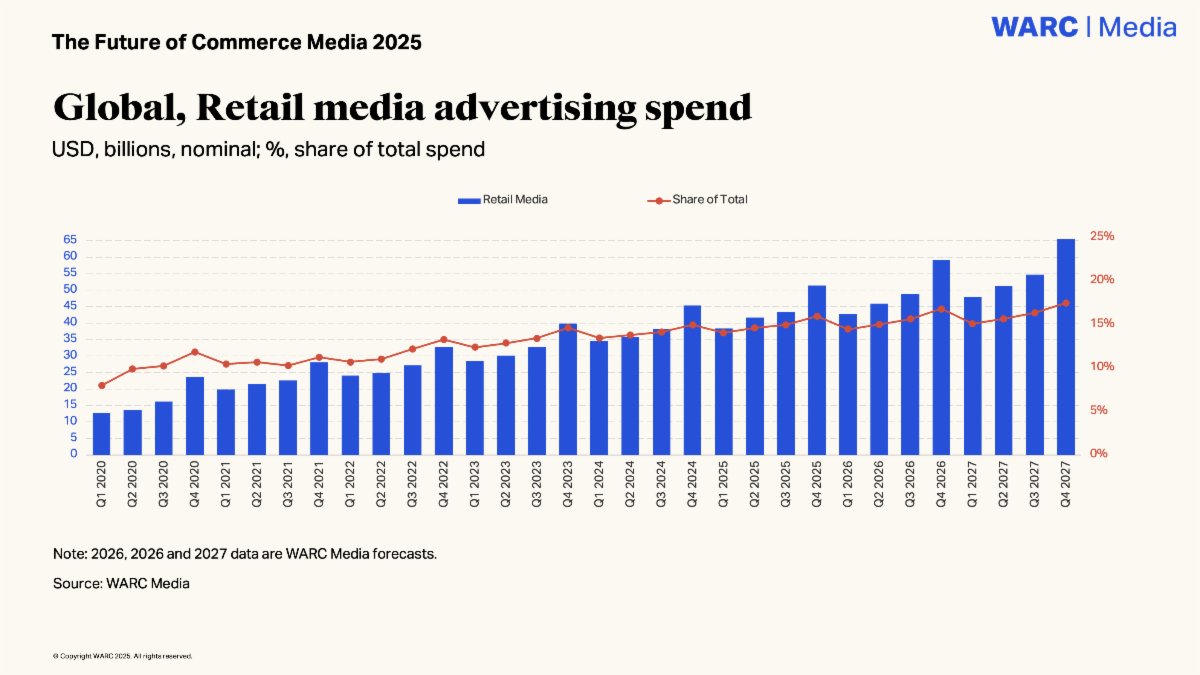

According to the latest WARC Media forecast, worldwide investment with retail media networks (RMNs) is set to reach $174.9 billion this year, up 13.7 per cent year-on-year, before rising a further 12.4 per cent in 2026 to reach $196.7 billion, representing 16 per cent of all ad spend.

However, topline growth rates are steadily slowing towards single-digit levels – from 38.6 per cent in 2021 to a forecast growth rate of 11.6 per cent in 2027.

James McDonald, Director of Data, Intelligence & Forecasting, WARC, said: “Retail media is rapidly evolving from a lower-funnel, search-dominated channel into a full-funnel proposition. Display advertising currently represents less than 30 per cent of total on-site retail media spend, however, this balance is poised to shift as retail media becomes more integrated with brand digital budgets. Much may depend on the adoption of agentic AI, which threatens the high human traffic volumes that have monetised the retail media networks to date.”

A closer look at the retail media ad spend shows that:

- Retail media ad investment is forecast to overtake combined linear and connected TV spend in 2026.

- Spending growth from endemic brands (i.e. advertised products which are sold directly by a retailer) is decelerating.

- Retail media ad spend for technology and electronics brands, the largest category, is forecast to reach $32.2 billion globally in 2026, up 15.4 per cent year-on-year.

- Future growth is likely to come from display and off-site. In the first half of 2025, UK advertiser investment with display retail media increased 41.6 per cent year-on-year, compared to a 35.6 per cent rise in search retail media ad spend.

- Quick-commerce (q-commerce) is a key area of expansion, especially in Asian markets. Instacart, Uber, Delivery Hero and DoorDash each boast annual ad businesses worth more than $1 billion.

- Scale will be a major determinant of retail media networks (RMN) viability in a decelerating market, as brands become more discerning about where to place commerce media investments.

- Tariff concerns boosted retail media spend in H1 2025, particularly in Europe, as brands pulled budgets forward in fear of disruptions.

Commerce media is emerging as a full-funnel proposition

Commerce media is emerging as a full-funnel solution, with more ad formats and channels to complement granular first-party data. A recent survey by ad-tech company Infillion found that two in five (40 per cent) of agency-side executives who buy retail media see it as a full-funnel solution, and another 7 per cent agreed it is an upper-funnel opportunity.

But new strategies and definitions of success will be needed to help this channel escape from a tight focus on narrow, lower-funnel conversion and from relying on siloed metrics like ROAS.

There are a growing number of retail media channels and ad formats that can support truly full-funnel strategies. CTV, off-site, digital out-of-home, and in-store advertising can enable brands to execute full-funnel strategies that bridge digital and physical shopping experiences.

Best practices from other channels, especially around the need to use more media options and run longer campaigns, also apply to retail media.

Amazon aspires to dominate open web advertising

Amazon, the world’s largest commerce media seller, continues to dominate the commerce media landscape, maintaining 15 per cent year-on-year growth, per WARC Media, through its full-funnel expansion and strategic demand-side-platform (DSP) partnerships.

Inventory partners now include Roku, enabling advertisers to reach an estimated 80m US connected TV households, and big hitters like Disney, Netflix, Spotify and Microsoft. Amazon claims its ad-supported monthly reach in the US has tipped over 300 million, while eight in 10 UK households can be reached with Amazon DSP.

Research by Skai found that more than 20 per cent of all ad investment with Amazon is now allocated to its demand-side-platform (DSP) – double the share recorded two years ago – as advertisers look for greater efficiency.

Agentic AI commerce arrives

Agentic AI commerce – shopping powered by AI agents – is generating significant hype as the future of online shopping. The total addressable market for agentic commerce has an estimated value of $136 billion in 2025 and has been forecast to grow to hit a potential $1.7 trillion by 2030, according to Edgar, Dunn & Company.

Test-and-learn strategies could be useful, but it will be essential to meet real consumer needs, not just develop new tech tools with no strategic purpose. The lessons of adapting to past innovations can be put to good use in thinking about how, when and where to potentially deploy agentic commerce.

When using agentic tools, it is important to view results in a holistic way. Narrow metrics are not reliable success indicators. Whilst it could be tempting to over-credit AI tools for sales, many inputs, from brand equity to emotion-led creative and seasonality, also have a role.

Other posts by :

- IRIS2 free for government usage?

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”