Forecast: LatAm FAST households at 52m by 2029

October 16, 2025

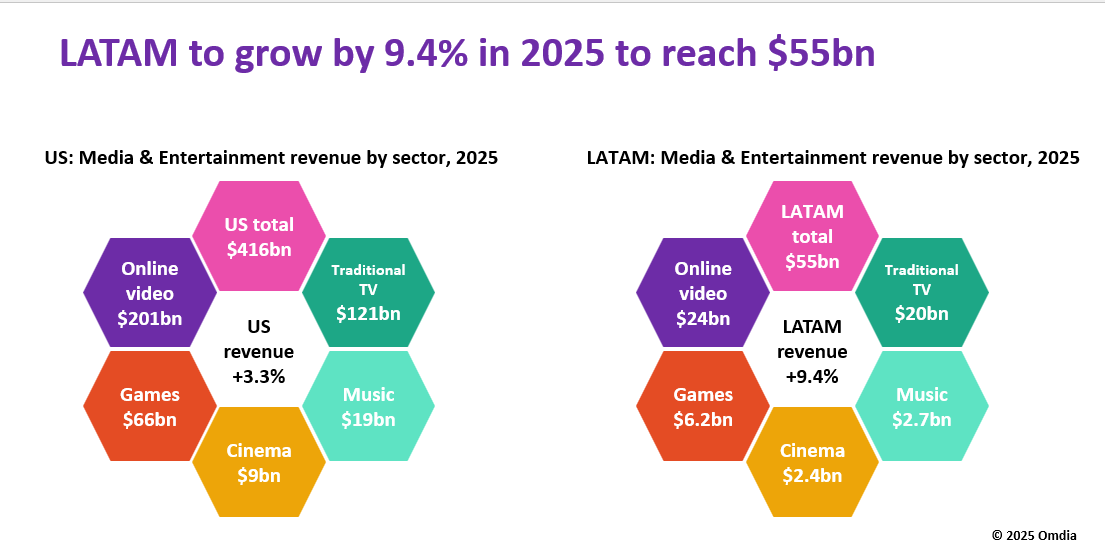

The Latin American media and entertainment market is experiencing unprecedented transformation, with streaming adoption and ad-supported business models propelling the region toward $55 billion (€47.2bn) in revenues by 2025, according to Omdia research presented at MIPCOM.

Maria Rua Aguete, Head of Media and Entertainment at Omdia, revealed during a MIP Cancun preview panel that Latin America’s media revenues will grow 9.4 per cent in 2025 — three times the 3.3 per cent growth expected in the US. This surge spans online video, television, gaming, music and cinema sectors.

FAST Revolution Transforms Regional Landscape

The region’s Free Ad-Supported Streaming TV (FAST) sector is experiencing strong growth, with Omdia forecasting FAST households will more than double from 26 million in 2024 to 52 million by 2029. Simultaneously, AVoD revenues are projected to climb from $2.1 billion to $5.4 billion over the same period.

Latin America has emerged as one of the fastest-growing regions globally for FAST advertising revenue, with the category expected to expand 2.3x by 2030, outpacing North America and Europe in percentage growth terms.

Brazil Rises to FAST’s Global Top Tier

“Brazil is now the third-largest market for FAST services outside the US — and will climb to No. 2 ahead of Canada in revenues by 2029,” Rua Aguete said. “It’s not just about adoption; it’s about monetisation”

According to Omdia, Brazil’s online video revenues will reach $14.4 billion by 2029, with $3 billion of that increase coming from advertising. Brazilian consumers are increasingly choosing free services over additional subscriptions, with platforms like Pluto TV, Samsung TV Plus and Tubi now ranking among the country’s top 10 most-watched services on Smart TVs, sitting alongside Netflix, Prime Video and Globoplay.

Online Video Dominates Market Share

Online video continues its dominance, set to reach $24 billion next year while outpacing traditional segments including TV ($20 billion), games ($6.2 billion), music ($2.7 billion), and cinema ($2.4 billion). Brazil maintains its regional leadership position, projected to account for 40 per cent of all FAST subscriptions by 2029.

Local Content Drives Growth

The region’s appetite for local and Spanish-language productions remains a key growth catalyst. Platforms including Globoplay, Netflix, Movistar and Claro continue expanding through strategic partnerships and investment in regional storytelling.

“The region’s combination of youthful audiences, expanding broadband, and rising advertiser interest makes Latin America one of the most exciting markets globally,” commented Rua Aguete.

Other posts by :

- IRIS2 free for government usage?

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”