Research: Value-added bundles winning US consumers

August 12, 2025

With rising inflation and growing pressure on household budgets, US consumers are feeling the strain, especially when navigating an increasingly fragmented and costly TV subscription landscape. Since 2018, Hub Entertainment Research’s Monetizing Video has tracked how consumers prioritise spending across TV and streaming services, which services and features offer the best value.

Key findings from the latest study:

Consumers paying for three or more subscriptions are spending more than they’d like.

It’s no surprise that the average user, spending $83 per month on TV services, say they are only willing to spend a few dollars more ($86). Consumers are tapped out on paying for multiple subscriptions – those paying for three or more services are spending more than they’d like and are unwilling to spend more.

New streaming bundles are a win for consumers.

Bundles introduced in the past year (e.g. Disney+ & Max, Hulu with Disney+) have dramatically improved subscriber loyalty.

· 42 per cent of users say they are much more likely to keep bundled services compared to services they subscribe to individually. The opportunity for streamers to create even more value-added bundles is a win-win strategy worth pursuing.

Low price is an obvious top attraction for TV services.

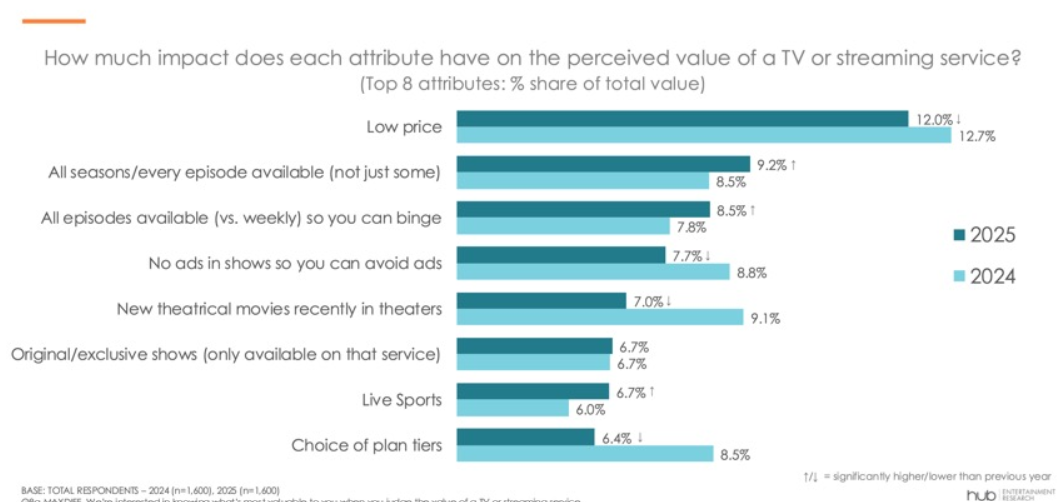

To better understand viewer priorities and how they value different aspects of TV services, Hub asked respondents to rank what they value most when choosing a TV service. Of 16 attributes tested, below are the top attributes and the percentage share they contribute to the total value of a service – with some notable changes since last year:

· ‘Low price’ by far still matters most to the value of a TV service (hence the growth of free services like YouTube, Tubi and the Roku Channel).

· Having access to full seasons and being able to binge watch have grown in importance; Netflix has made these attributes table stakes.

· Tolerance for ads has increased: having ‘no ads so you can avoid ads’ is less important vs last year, as users lean into using free services with ads.

· Demand for new theatrical movies on TV services has decreased as theater-going remains soft and viewers lean into plentiful original content from streamers.

· As leagues have sold more sports rights to streamers, live sports have become more important to consumers in how they value favorite teams and games.

· New, cheaper streaming tiers introduced since 2022 have softened interest in plan tier choices as they embrace new bundles of services.

“Emphasising ‘low price’ and ‘unlimited access’ are evergreen value drivers that streamers can lean into as they manage the ups and downs of new programming slates,” commented Jason Platt Zolov, Senior Consultant at Hub. “Leaning into attractive bundles of complementary services is proof-positive that combined services bring winning value and even stronger customer loyalty.”

These findings are from Hub’s 2025 Monetizing Video report, based on a survey conducted among 1,600 US consumers ages 16-74 with broadband access. Interviews were conducted in June 2025.

Other posts by :

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”

- Russia accused of eavesdropping on satellites

- FCC welcomes Musk’s 1m satellite plan