SES and Eutelsat possibly in line for C-band $bn bonus

February 10, 2025

The FCC is kickstarting the process to auction new C-band spectrum for use by US cellular operators and 5G expansion. The auction will wrap by mid-2026, according to FCC’s new Chairman Brendon Carr. Analysts at investment bank BNP Paribas say the news is “positive” for satellite operators SES and Eutelsat.

The FCC’s plan covers 3.98-4.2 GHz of spectrum for auction.

Media analyst Sami Kassab at the bank, in a note to clients, reminds investors that the FCC’s 2020 spectrum auction benefited by some $21 billion, split between SES, Intelsat, Eutelsat and a couple of smaller North American satellite operators.

The question now, says Kassab, is how much more C-band spectrum can satellite operators clear and how much will they earn from the FCC’s process. “We note that only a fraction of C-band transponders onboard SES 18 and SES 19 are currently in use. Satellite operators still use C-band for broadcasting distribution to 120 million homes in the US. We assume a further 100 Mhz [of satellite spectrum] could be cleared.”

“In the 2020 clearing phase, satellite operators received a net incentive payment of $32.3 million (in addition to the reimbursement of all clearing costs). Assuming the same conditions would bring a total of USD3.23bn. In 2020, Intelsat got 50 per cent, SES received 41 per cent and Eutelsat 5 per cent. Assuming a similar breakdown would bring SES (which is in the process of acquiring Intelsat) $2.94 billion and Eutelsat $169 million or respectively 82 per cent and 17 per cent of their current market capitalisation (assuming former Intelsat shareholders are entitled to 42.5 per cent of total C band proceeds earned by SES),” continued Kassab

That 2020 auction sold off 280 MHz of C-band spectrum and raised

However, there are some key areas of uncertainty: “It remains unclear whether under the new administration European satellite operators will be handed a similar incentive payment. However, we note that the same argument remains in favour of satellite operators, ie speed of delivery vs. long lasting legal battles. Secondly, it remains unclear to us to what extent former Intelsat shareholders are entitled to 42.5 per cent on the combined C-band spectrum rights or just on the former Intelsat share of C band spectrum rights,” added Kassab’s note.

“C-band had been a key driver of SES and Eutelsat share price a few years ago. We are likely to enter a similar phase witness the strong bounce in SES share price yesterday. Relative C-band exposure, as well as operating trends, is one of the key reasons we reaffirm our stock ratings of Outperform on SES and Underperform on Eutelsat,” said the bank’s note.

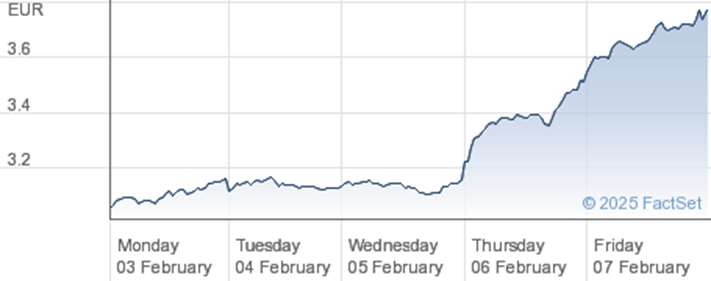

The stock market reacted favourably to the news, with SES shares jumping from €3.11 to €3.77 last week. SES has not commented on the speculation but more news should emerge at its results presentation on February 26th.

SES share price

Other posts by :

- Morgan Stanley downgrades Iridium

- SpainSat-NG II a total loss

- SES warns of risks for airlines adopting Starlink

- Starlink facing backlash in South Africa

- China wants 200,000 satellites

- Bank raises view on AST to $100

- Frost & Sullivan cites Hughes as #1

- Verizon cutting prices

- ScotiaBank confuses market over AST SpaceMobile