Data: Streaming, retail media revenue up 7.1% in 2025

January 7, 2026

By Nik Roseveare

Streaming services and retailers grew UK revenues from music, video and games by 7.1 per cent in 2025 to a new all-time-record of £13.25 billion (€15.3bn), according to interim annual figures published by digital entertainment and retail association ERA.

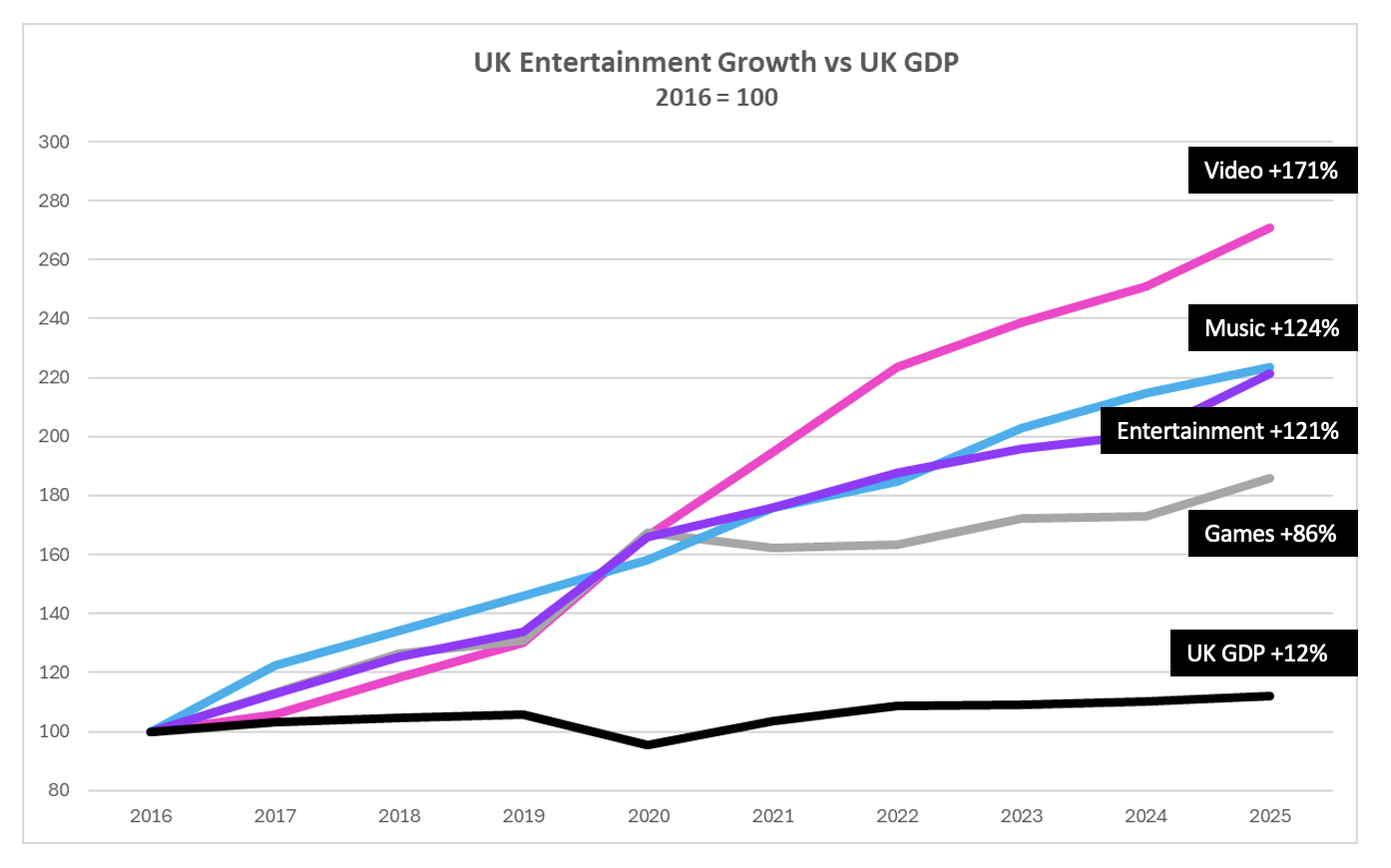

This was more than four times the 1.5 per cent GDP growth predicted for the UK economy by the Office for Budget Responsibility, and marks a sharp upturn in growth for the music, video and games sector compared with 2024.

Entertainment sales have grown by more than 120 per cent over the past 10 years, 10 times faster than the UK economy which has grown just 12 per cent over the same period.

Broken down by sector, revenue from games grew more than seven times more than the UK economy over the same period (+86 per cent), music grew more than 10 times (+124 per cent) and video more than 14 times more than the UK economy (+171 per cent).

ERA CEO, Kim Bayley, commented: “This result vindicates the transformational role of streaming services and retailers in driving the entertainment sector to new heights, thanks to a potent combination of technology, investment and innovation. While conditions may be tough in the wider economy, streaming services and retailers are winning a greater share of consumer spending and proving their central role in the UK’s creative economy, driving revenues for musicians, filmmakers and games developers.”

Entertainment’s 7.1 per cent growth rate in 2025 was more than double the growth seen in 2024 (+3.3 per cent) and the fastest growth seen since the pandemic year of 2020 (+24.1 per cent).

Video revenues increased by 8 per cent to £5.43 billion, their highest growth rate since 2022. Games grew by 7.4 per cent, their fastest growth rate since the pandemic year of 2020. Music was up 4.2 per cent with physical formats up 11.5 per cent. This comes in sharp contrast to the modest growth see in UK retailing overall.

The combined value of the music, video and games sectors is now nearly double the £6.72 billion they recorded as recently as 2017 and 66 per cent higher than the last pre-pandemic year of 2019.

Bayley added: “Approaching five years after the first lockdown when entertainment revenues leapt an extraordinary 25 per cent in a year, it is now clear that it was more than a blip. It marked a long-term shift in entertainment spending which streaming services and retailers have solidified with a string of innovations.”

MUSIC

Sales of streaming subscriptions and music product reached a new all-time-high of £2.45 billion in 2025. Revenues from streaming subscriptions increased 3.2 per cent to £2.04 billion. Physical music sales grew 11.5 per cent to £368.1 million, propelled by an 18.5 per cent increase in vinyl revenues and a 95 per cent increase in other physical formats (predominantly cassette) to £4.6 million. CD revenues were largely flat (down 1 per cent) to £125 million.

Physical formats increased their share of music revenues to 15 per cent, their highest share since 2021.

For the second year running Taylor Swift produced the biggest-selling album and biggest-selling vinyl album of the year with The Life Of A Showgirl with sales of 642,469 albums, 147,382 of them on vinyl. The biggest single of the year was Ordinary by Alex Warren which generated the equivalent of 2.18 million sales.

2025 saw a strong showing by emerging UK artists such as Olivia Dean, Lola Young and Skye Newman, amid a combined effort by digital services, retailers and record labels to support homegrown talent.

Bayley stated: “Streaming services in the UK fund around 60 different programmes supporting music, with a third of them focussing on new and emerging UK talent. Record shops too are playing their part, promoting more than 4,000 instore and outstore performances a year, the majority of them featuring UK artists. Streaming services and retailers are committed to supporting new UK music and the emergence of a new wave of UK artists is vindicating their approach.”

VIDEO

For a second successive year, video was the largest of the three sectors surveyed by ERA, with growth increasing to 8 per cent (2024: 5.1 per cent) to reach £5.43 billion.

SVoD services such as Prime Video and Netflix saw revenues increase 8.8 per cent to £4.9 billion while the value of film downloads increased 7.4 per cent to £202 million. Sales of physical video formats of video including DVD and Blu-ray declined 4.7 per cent (2024: -8 per cent) to £148.9 million, their slowest rate of decline since 2010. Blu-ray (inc 4K UHD) reinforced its position as video’s strongest physical format with sales of £84.2 million compared with DVD’s £64.7 million.

The biggest-selling title of the year was Wicked with sales of 983,119, a substantial increase on 2024’s biggest seller Deadpool & Wolverine (561,917).

Bayley stated: “Thanks to the investment and innovations of streaming companies the video business is now nearly the twice the size it was at the height of the DVD boom in 2004 (£2.95 billion). Video is arguably the best example of the transformational power of streaming to deliver choice, convenience and accessibility. Meanwhile there are promising signs in the physical format market with a sharp fall in the rate of decline as studios and retailers lean into physical’s distinctive benefits of quality and collectability.”

GAMES

The games sector scored a stunning 2025, growing 7.4 per cent to £5.36 billion, achieving more in 12 months than it did in the four years between 2021 and 2024 (+6.7 per cent).

A key factor was an 8.8 per cent increase in revenues from mobile and tablet games to £1.88 billion accelerating the 5.5 per cent growth seen in 2024. There was also strong 11.5 per cent growth in full-game console downloads to £857.6 million.

Sales of physical console games stuttered, down 1 per cent £318.8 million. Nonetheless games remains the last bastion in entertainment of ownership rather than access models. Nearly half of games revenues (45 per cent) are generated by fans paying to buy rather than access them, compared with 16.6 per cent in music and just 7.2 per cent in video.

The biggest-selling game of the year was EA Sports’ FC 26 with more than 1.97 million units sold across digital and physical formats.

Bayley stated: “Growth in the games market slowed considerably after the incredible 27.9 per cent gains seen in the pandemic year of 2020, but continuing innovation saw it return to form in grand style in 2025. We have strong hopes that it will maintain this momentum into 2026.”

Reacting to the report, Jennifer Holmes, CEO of the London Internet Exchange, commented: “Since Covid, we’ve noticed a real incline in internet traffic driven by the streaming boom, with people shifting towards always-on digital entertainment such as video, social media and gaming. As demand continues to rise, it’s important to remember the importance of the underlying infrastructure that powers this content, requiring resilient, low-latency networks that can handle both steady growth and peak demand.”

“New film and series releases, gaming updates and large sporting events, place significant demands on networks where their consumers expect high-quality, reliable streaming. Efficient interconnection plays a vital role in delivering seamless experiences, supporting new forms of digital content and enabling the streaming boom at scale. Streaming will continue to rise in demand and power the economy, and at the London Internet Exchange we are pleased to provide low-latency peering services that help platforms and networks deliver faster, more reliable services to people across the UK and beyond,” added Holmes.

Other posts by :

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”

- Russia accused of eavesdropping on satellites