Report: Larger TV size sales continue to grow

December 1, 2025

By Chris Forrester

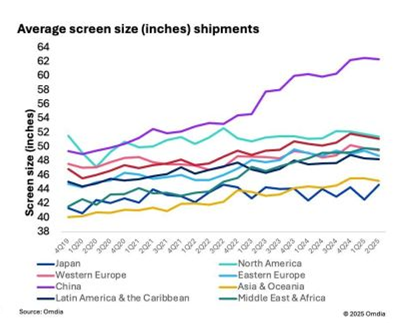

A report from analyst Paul Gray, delivered at the Seville, Spain, 4K HDR Summit in mid-November, showed China’s rapid shift toward larger TV sizes — with 65-inch now becoming the average size of new sets sold this year in Europe. China’s unique manufacturing and logistics advantages are accelerating this growth, says Gray, while aggressive innovation from brands like TCL and Hisense driving fast adoption of high-performance MiniLED-equipped displays.

Gray also highlighted rising global pressure on TV makers to build recurring-revenue ecosystems, regional differences in ad-supported models, and why hashtag#8K remains essential for capture, immersive displays, and next-gen viewing experiences.

However, the Ultra HD share of global TV sales is plateauing at 70 per cent. Moreover, the availability of 8K sets, so-called ‘Super Hi-Vision’ remains negligible. HD holds at 30 per cent, perhaps remarkable because these are sets below 40″ only, despite average screen sizes keep creeping up.

The data coincides with an Omdia report that Global TV shipments dipped 0.6 per cent in Q3 2025, with international growth balancing China weakness. Actual TV shipments fell slightly year-on-year to 52.5 million in Q3 2025, as one of the largest markets declined rapidly. Demand for TVs in China has been boosted by government subsidies over the last year, but funding is now running out in some regions and many consumers have already upgraded. As a result, in year-on-year shipments fell 11.2 per cent, according to Omdia’s new quarterly TV Sets Market Tracker.

The biggest regional fall was in China, down 12.2 per cent, while another key market, North America, grew 2.3 per cent, as consumers continue to defy the expected economic impact of tariffs. Equally notable in the third quarter was the strong growth in Asia & Oceania of 7.7 per cent, indicating that Chinese TV brands are looking toward neighbouring countries to compensate for falling domestic demand.

“Chinese brands have already made significant progress in taking market share around the world and their subdued local market will likely accelerate these efforts,” said Matthew Rubin, Principal Analyst, TV Set Research, Omdia. “In the US, tariffs and capacity constraints in Mexico complicate the drive toward quick growth, but in Europe and other Asian countries, notably India, there is more accessible opportunity”.

The slowdown in China has also impacted the rate of growth for the 80 inch and larger segment, with expansion almost halving from over 40 per cent each quarter over the last year, to just 23.1 per cent in Q3 2025. The 70-79 inch category has also cooled, with year-on-year growth of only 1.1 per cent. This presents a strategic dilemma for Chinese brands, which have focused on low-cost, large screen TVs in key markets like North America and China. As attention shifts to Europe and Asia & Oceania, average size preferences are considerably smaller – 62.8 inches in China compared with just 45.5 inches in Asia & Oceania for Q3 2025.

Other posts by :

- Bank: “Charter racing to the bottom”

- SpaceX IPO in June?

- Russia postpones Starlink rival

- Viasat taps Ex-Im Bank to finance satellite

- Bank: TeraWave not a direct threat to AST SpaceMobile

- SpaceX lines up banks for IPO

- SES to FCC: “Don’t auction more than 160 MHz of C-band”

- Morgan Stanley downgrades Iridium