Korea’s premium VoD market tops $1.1bn in H1

August 18, 2025

Korea’s premium VoD market reached $1.1 billion (€0.94bn) in H1 2025, with paid SVoD subscriptions climbing to 24.5 million and 1.5 million net new additions during the period, according to insights from ampd, the measurement platform owned and operated by Media Partners Asia (MPA).

Growth was concentrated among scaled leaders, while the introduction of connected TV (CTV) measurement from Q2 2025 significantly expanded reported reach and engagement, adding ~35 per cent more MAUs per platform and nearly doubling total measured viewing hours to 1.2 billion in Q2. Netflix maintained leadership with 8.2 million subscribers and 47 per cent of premium VoD viewership, driven by local hits such as Squid Game Season 3, a steady flow of licensed box-office films, and the Naver Plus partnership offering its ad-supported Standard plan free to members. TVING delivered the largest net additions, fueled by an affordable ad-supported tier, variety and drama pipelines, and live sports. Coupang Play expanded its footprint with a free ad-supported tier and the launch of Sports Pass, while the TVING–Wavve merger, approved in June, is set to create a 9.2 million-subscriber domestic challenger to Netflix by year-end.

“Korea’s premium VoD sector is consolidating around a handful of scaled leaders,” said Vivek Couto, Executive Director of MPA. “Local storytelling remains the foundation of engagement and monetisation, while CTV is unlocking new audiences and advertising opportunities. The TVING–Wavve merger will reshape competition, providing a stronger domestic counterweight to Netflix’s scale.”

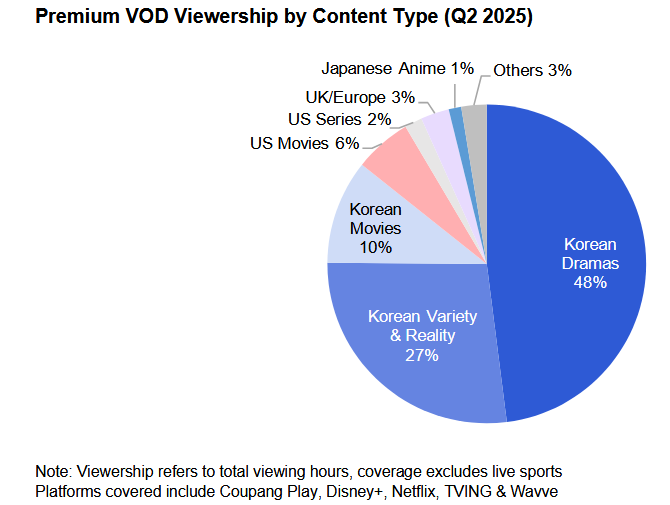

Local content accounted for 86 per cent of total premium VoD viewing hours in Q2, led by Korean dramas (48 per cent) and variety/reality programming (27 per cent). Netflix carried much of the drama viewership, while TVING and Wavve anchored variety. Foreign content remained niche, with US movies the largest non-local category at 6 per cent of viewing hours.

“Korean content’s dominance is near-universal, reaching 88 per cent of all premium VoD users,” added Dhivya T, Lead Analyst at MPA and ampd. “K-dramas, comedy, and variety shows drive cross-platform reach, while high-profile exclusives on Netflix, TVING, Coupang Play and Disney+ add competitive edge. Advertising tiers are now central to subscriber acquisition, especially in urban and price-sensitive segments.”

Across the 10 Asian markets in which we operate, ampd leverages passive panel members using Saas based products, led by ampd Vision, focusing on the streaming VoD sector while providing customized research to our clients across a variety of sectors including VoD, Content, Advertising, Telecoms and more. Our clients include leading global internet and technology brands, Hollywood and Asian content studios, advertising agencies, telcos and pay-TV operators.

Other posts by :

- Starlink success in Spain, but South Africa proves difficult

- RocketLab doubts over Mynaric bid

- IRIS2 free for government usage?

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India