Report: Sports account for 24% of new paid TV subscriptions

August 5, 2025

According to Worldpanel by Numerator’s Entertainment on Demand (EoD) Q2 2025 report, sports content now account for 24 per cent of new paid TV subscriptions as global streaming platforms such as Netflix and Prime Video double down on partnerships and exclusive rights deals. This aligns with the rising popularity of women’s football, now watched by one-third of football-watching households in the UK, Germany, Spain and France.

Disney+ stands to benefit having secured pan-European rights to the UEFA Women’s Champions League, with all 75 matches from the coming season available at no extra cost to subscribers. Three in 10 global households currently subscribe to Disney+, presenting a clear growth opportunity.

Live sports are becoming a cornerstone of streaming strategies, helping platforms to attract new audiences and retain existing subscribers through diversified content. Globally, 45 per cent of households now watch sports regularly, rising to 47 per cent among VoD subscribers; this is expected to grow in Q3 as major sporting seasons kick off after the quiet summer period.

Dominic Sunnebo, Commercial Director at Worldpanel by Numerator, commented: “Big sporting events have long been a foundation of successful broadcasting programmes, with their unique ability to bring global audiences together in a way nothing else can match. It’s savvy for streamers to start partnering with globally recognised sporting networks that audiences cherish, whether it’s Netflix becoming the exclusive home of the WWE or DAZN’s decision to air the FIFA Club World Cup. But the deals are only the start – these platforms need to consistently deliver a slick, engaging fan experience before people strongly associate them with sports.”

Ad-supported tiers redefine the streaming experience

Ad-supported streaming continues to gain momentum, with paid ad-tiered subscriptions rising 3 per cent quarter-on-quarter and achieving 14 per cent growth since the start of 2025. More than half of households now have one of these services, with 31 per cent of new subscriptions in Q2 (vs 22 per cent a year ago) attributed to paid ad-supported VoD, rising notably to 37 per cent in the UK and 42 per cent in France.

A turning point came when Prime Video reshaped the landscape in early 2024, automatically enrolling all subscribers into its ad-supported plan unless they opted to pay extra to go ad-free. While ad satisfaction with Prime Video has steadily improved since then, the platform continues to trail key competitors.

According to subscriber feedback from Worldpanel by Numerator, discovery+ stands out as the leader in ad experience satisfaction across metrics such as frequency, duration, relevance and variety. Disney+ and Netflix follow closely, with Disney+ almost rivalling discovery+ for ad relevancy and variation.

The power of discoverability and localised offerings

Over the course of the last year, European markets have led VoD growth, with market penetration increasing by 2 per cent and overall subscriptions up by 10 per cent. Notably, local services such as WOW, Joyn, Waipu, Filmin, Mitele and TF1 have shown exceptional growth, building on a strong upward trajectory over the past year.

Sunnebo added: “Growing demand for localised content is having a knock-on impact on VoD providers, with regional platforms seeing significant growth. For global players like Netflix, Disney+, and Prime Video, this presents a significant challenge as well as an opportunity to create partnerships that help them pick up subscribers around the world.”

Although Netflix remains the leader in overall content satisfaction and discoverability, the rollout of Netflix’s new user interface in May received mixed reviews. Net satisfaction in the interface declined in Q2, putting pressure on the platform’s longstanding strengths: a highly personalised user experience and an industry-leading recommendation algorithm.

Additional insights from the report:

- Localised content and services saw the highest percentage growth, driven by strong demand for culturally relevant programming and tailored offerings.

- Overall, it was a slow quarter for growth with the percentage of households (4 per cent) onboarding new subscriptions at their lowest level since Q2 2023.

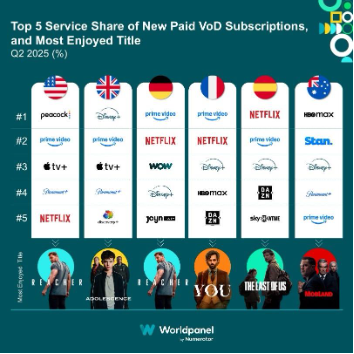

- Prime Video led in new paid subscriber share by capturing 14 per cent of the market, with Disney+, Netflix and Apple TV+ close behind.

- YouTube Premium emerged as a standout, achieving growth of 17 per cent since the start of 2025.

- Pluto TV continued to struggle with viewer retention in 2025, while rivals such as Samsung TV+, LG Channels and Tubi maintained strong growth trajectories.

- Following the news of RTL Group’s acquisition of Sky Deutschland, its streaming platform WOW reported a rapid acceleration in growth, with the addition of almost 250k new subscribers in the quarter.

- Prime Video’s Reacher was the most enjoyed show of the quarter, followed by The Last of Us, You, The Handmaid’s Tale and Andor.

- 17 per cent of new subscribers cite brand strength as a primary motivator in signing up to streaming platforms.

Other posts by :