Forecast: Shipments of 80-inch+ TVs to rise 44% to 2029

September 23, 2025

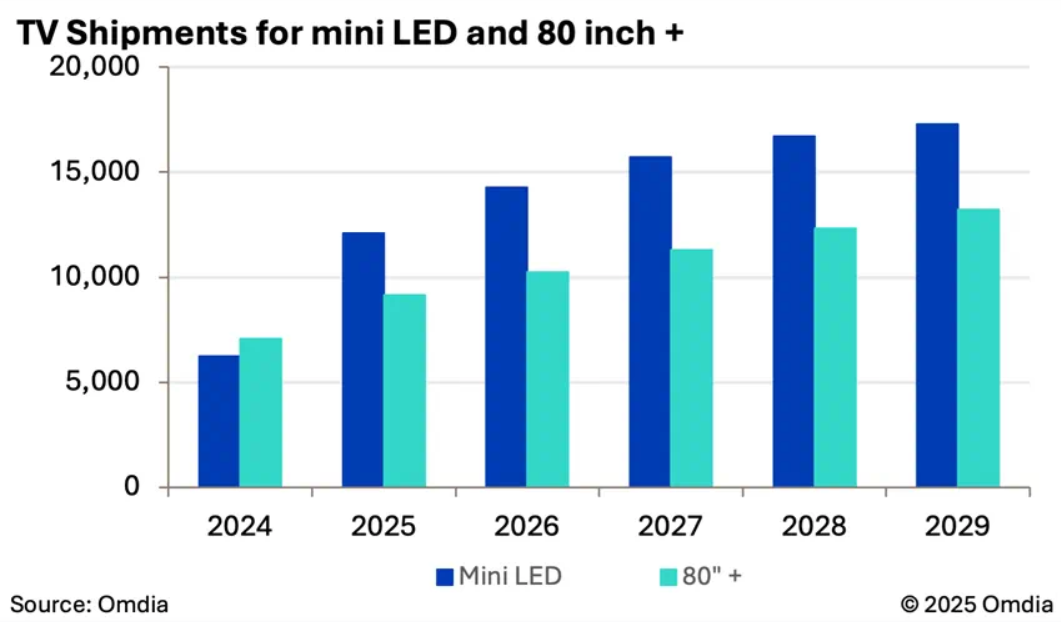

Annual TV shipments are projected to see minimal growth over the next five years, but the ultra large segment (80 inches and above) is expected to increase by 44 per cent from 2025 to 2029, representing a CAGR of 10 per cent, according to analysis from Omdia’s quarterly TV Sets Market Tracker. Falling prices of ultra-large LCD TVs combined with advances in backlight technology are set to drive this expansion.

Omdia projects overall global annual TV shipments to edge up from 209 million units in 2025 to 211 million in 2029, a modest CAGR of just 0.4 per cent. Despite this slowdown in the broader market, several key segments and technologies are on track for rapid growth.

Shipments of TVs 80 inches and larger are forecast to rise from 9 million units in 2025 to over 13 million by 2029. China and North America will continue to dominate demand for ultra-large sizes accounting for 54 per cent and 28 per cent of volume, respectively, in 2029. Western Europe, where smaller screen sizes have traditionally dominated due to limited living space, is also set for growth, climbing from 503,000 units in 2025 to 643,000 in 2029.

“Considerably lower prices for ultra large TVs are making this premium category accessible to many more consumers,” commented Matthew Rubin, Principal Analyst, TV Set Research, Omdia. “This stark change in pricing dynamics is being driven by a combination of manufacturing efficiencies and Chinese brands prioritising market share and brand visibility over profitability in the $1000-plus premium segment.”

Another core growth area through 2029 will be mini LED, particularly the premium RGB mini LED subsegment. Annual shipments of mini LED TVs are forecast to increase from 12 million in 2025 to 17 million in 2029, a CAGR of 9 per cent. White light mini LED is expected to dominate the mass market, while RGB mini LED, introduced in 2025 by Hisense and Samsung, will expand as more brands adopt the technology from 2026 onward.

Although RGB based technology is initially more expensive to manufacture – with Hisense’ first 116” RGB TV in Europe priced at €24,999 – costs are expected to decline swiftly. The technology could follow a trajectory similar to the wider mini LED market, which began as a premium feature but rapidly migrated into mid-range TV sets. RGB technology offers several advantages, including up to 100 per cent colour coverage of BT.2020, and avoids the cost-scaling issues for larger screen sizes, that OLED faces.

Other posts by :

- Bank: “Charter racing to the bottom”

- SpaceX IPO in June?

- Russia postpones Starlink rival

- Viasat taps Ex-Im Bank to finance satellite

- Bank: TeraWave not a direct threat to AST SpaceMobile

- SpaceX lines up banks for IPO

- SES to FCC: “Don’t auction more than 160 MHz of C-band”

- Morgan Stanley downgrades Iridium