Report: Demand for K-content grows as commissions shrink

August 18, 2025

A report by Ampere Analysis reveals that while global audiences are watching more South Korean content than ever, both international streaming platforms and local commissioners are producing fewer new TV titles. Local companies have struggled with rising production costs and the broader macroeconomic challenges, while international SVoDs are shifting their content strategy towards acquisitions and Original Unscripted K-content.

As the streaming giants adapt their strategies in South Korea, Ampere believes there are opportunities for a reinvigorated local production landscape.

Key findings: Strong demand, fewer commissions

- The international popularity of South Korean content remains high. The share of viewers outside Korea who say they watch South Korean TV series or films “sometimes” or “very often” rose from 22 per cent in Q1 2020 to 35 per cent in Q1 2025 — a 13 per cent increase.

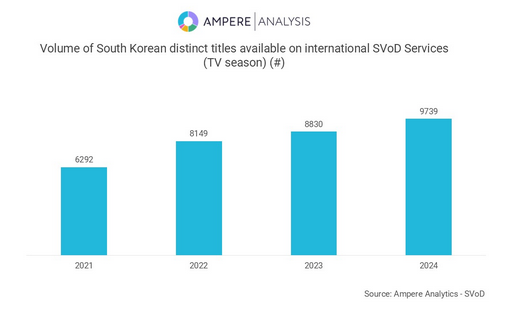

- The consistent growth of content on non-Korean streaming services has fueled demand. The availability of South Korean content on international streaming services increased by 55 per cent between 2021 and 2024.

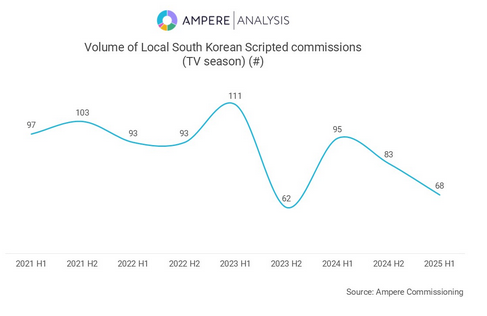

- Commissioning has slowed sharply. Overall, South Korean TV show commissions fell 20 per cent between the first halves of 2023 and 2025. Global streamers reduced commissions by 43 per cent, while local productions cut back by 20 per cent.

- Scripted commissions have been hit the hardest. Local commissioners are battling rising production costs and the high expectations of a global audience against the backdrop of worldwide inflationary pressures, meaning they are struggling to meet demand. This has particularly affected Scripted announcements – the most popular titles internationally. These dropped 39 per cent between H1 2023 and H1 2025.

- While other global SVoDs have cut Korean commissions, Netflix has maintained commissioning volume. The streaming giant accounts for 88 per cent of South Korea’s H1 2025 global SVoD announcements, but has reduced its proportion of scripted content as it shifts its focus to Unscripted.

Mariana Enriquez Denton Bustinza, Analyst at Ampere Analysis, commented: “Korean content has leapt onto the international stage, reaching worldwide success with both global SVoD Originals and local titles. However, despite continued demand for K-content, TV show commissions from local and global players have declined, with global SVoDs changing content strategies from scripted Originals to focus on acquisitions, and in Netflix’s case, producing a higher proportion of Unscripted titles. Despite struggling with inflated costs, this leaves the export market open for South Korean commissioners, especially now that Netflix is reportedly considering the introduction of caps on actors’ fees,

Other posts by :

- FCC eyes freeing up Weird Space Stuff spectrum

- SES happy with releasing 160MHz of spectrum for 5G

- Inmarsat “likely to win appeal” over Ligado/AST action

- FCC seeks fair play over foreign satellite access

- Bank raises RocketLab target price

- Ukraine wants its own LEO system

- SpaceX outlines Starlink cellular delivery plan

- NAB vs CTIA on C-band release