Research: Huawei tops China smartphone market in Q2

July 28, 2025

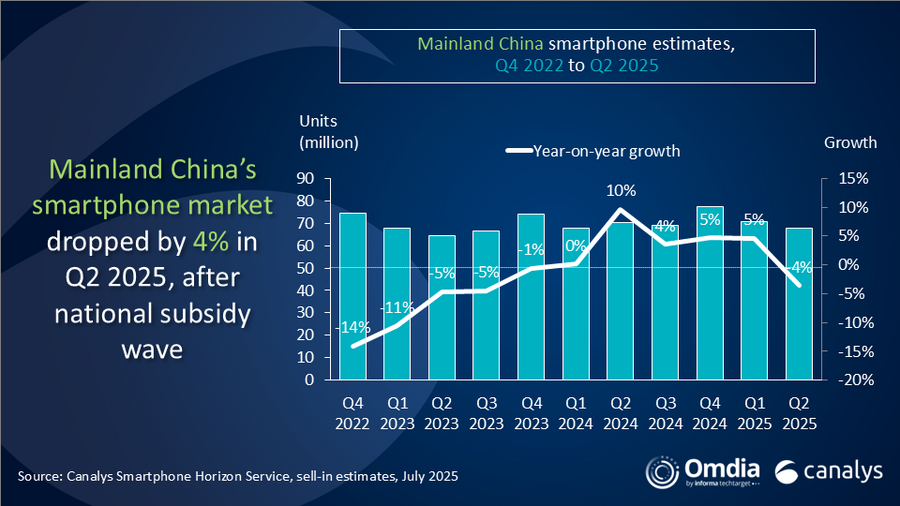

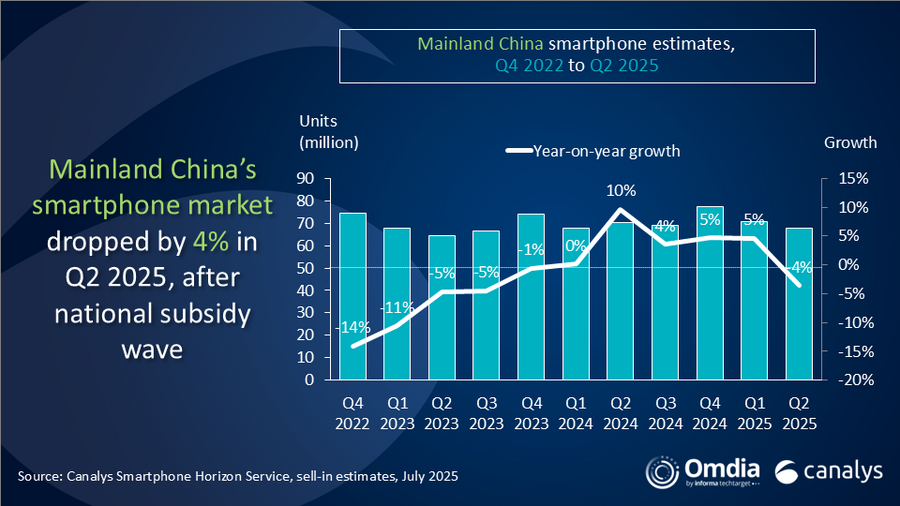

According to research from Canalys (now part of Omdia), the Mainland China smartphone market declined 4 per cent year-on-year in Q2 2025, as the boost from national subsidy programmes earlier in the year began to taper off.

Huawei reclaimed top position with shipments of 12.2 million units, capturing an 18 per cent market share. vivo followed closely with 11.8 million units shipped, taking 17 per cent share. OPPO (including OnePlus) secured third with 10.7 million units, and 16 per cent share. Xiaomi, continuing its eighth consecutive quarter of annual growth, took fourth spot with 10.4 million units. And Apple ranked fifth with 10.1 million units.

“The Q2 correction is mainly a result of reshaped seasonality driven by the national subsidy program in early 2025,” said Amber Liu, Practice Leader at Canalys. “Despite the slowdown, underlying consumer demand remained resilient, with first-half shipments slightly increasing year-on-year. In response to the early-year upgrade peak, major e-commerce platforms and vendors jointly launched earlier promotions in mid-May for the ‘618’ shopping festival, combining aggressive discounts, financing options, and IoT bundles to sustain momentum. In Q2, Apple strategically adjusted its pricing for the new iPhone 16 series, to drive demand during the shopping season. However, its early momentum was hampered by national subsidy eligibility issues due to its higher price points.

“Vendors continued to execute differentiated strategies across software, in-house R&D, and product launches,” commented Lucas Zhong, Analyst at Canalys (now part of Omdia). “Huawei launched the Nova 14 series, its first Nova lineup to feature HarmonyOS 5.0. This move is expected to accelerate the expansion of its independent ecosystem’s user base, while also placing greater demands on system compatibility and user experience. vivo rolled out new models across its X200, S30, and Y300 series, leveraging a staggered release strategy to target a wider range of customer segments. Xiaomi unveiled its in-house chipset XRing O1 in May, powering its flagship Xiaomi 15s Pro and Xiaomi Pad 7 Ultra, signaling a long-term commitment to in-house R&D and premium offerings. The brand continues to expand its offline retail presence and experience to advance its “Human x Car x Home” strategy. HONOR is focusing on revitalising growth through competitive mid-range offerings and has implemented a disciplined and effective channel approach.

“Mainland China’s smartphone market is on track for modest full-year growth and is set to outperform the global market in 2025,” added Liu. “In the second half, consumer sentiment is expected to continue recovering amid signs of economic resilience. Inventory levels remain healthy, as vendors took a cautious channel approach to avoid stockpiling during the subsidy wave. With much of the demand pulled forward in H1 by subsidies, vendors now face the challenge of maintaining upgrade momentum. Going forward, success will hinge on delivering product innovation and clear differentiation to capture consumer interest. At the same time, the channel landscape, reshaped by Huawei’s supply recovery and national subsidy programme over the past year, is gradually stabilising. Vendors must now focus on providing long-term value to channel partners to consolidate and leverage their partnerships—an essential move for delivering strong performance in the second half of the year and going forward.”

Other posts by :

- IRIS2 free for government usage?

- Bank: AST SpaceMobile will orbit 356 satellites by 2030

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”