AST SpaceMobile plays Game of Phones

August 14, 2025

The banking analysts have had time to chew over AST SpaceMobile’s half-year update. The advice given is – at best – mixed. Some analysts have increased their Price Targets while other have reduced or softened their Targets.

Recent Analyst Price Target Changes for AST:

· B Riley was $44, now $60

· Deutsche Bank was $64 now $59

· Roth Capital was $51, now $56

· Scotia was $45.40, now $42.90

· Cantor now $30

· Oppenheimer: Not given

Oppenheimer & Co in its August 12th note for clients said: “We like AST’s technology and value proposition with an early mover advantage in a potentially massive, burgeoning D2D market. However, there remain a significant number of unknowns and amount of risk. Low visibility and current valuation keep us sidelined at Perform.”

Oppenheimer added that it continues to believe AST possesses promising technology in a nascent D2D market, “but await a better entry point and more confidence in its deployment schedule, technology and business model.”

Roth Capital was more optimistic, saying: “With the recent slate of financing activity ($575 million convert, ATM, equipment financing, asset-backed spectrum financing), ASTS has ~$1.5 billion in cash on the balance sheet (July 31st). This effectively fully funds the AST.”

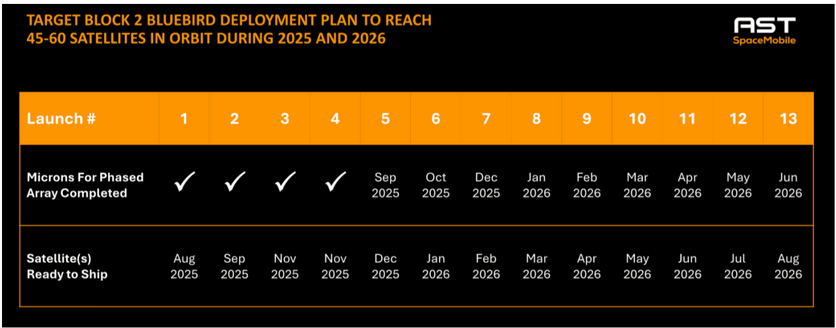

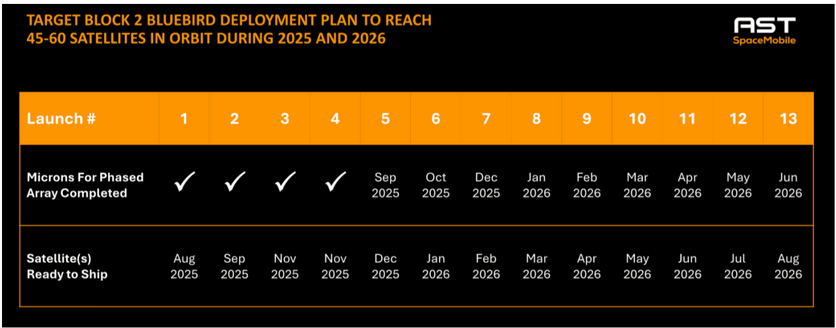

Roth admitted there has been some slippage in launch timelines, but AST remains comfortable with five orbital launches by the end of Q1 2026, and this enables an “intermittent” non continuous service.

Cantor’s Government, Technology & Space team advised clients not to view the company in terms of cashflow (which is negligible at the moment) but to look at the catalysts and its battle in the ‘Game of Phones’ with rival Starlink. They believe that AST can hit its stride, and investors should not ignore the possibilities of government take-up of AST’s services.

AST is about to ship its seventh satellite to India and to launch the craft shortly thereafter. Then there is a slew of satellites waiting to be launch between now and the end of Q1 2026. AST has six first-generation of its BlueBirds in low Earth orbit. The Block 2 second-generation satellites are 3.5 times larger and have 10 times the capacity of the earlier versions. This allows AST to start a commercial service with fewer spacecraft than would be required if it relied on the Block 1 version.

Other posts by :