Research: Familiar IP key to driving kids’ consumption on Netflix

November 5, 2025

With a steady flow of content, Sesame Street is a mainstay of children’s entertainment. Despite its global success, its future looked uncertain when Warner Bros Discovery chose not to renew its deal with the Sesame Workshop. Netflix stepped in to give Sesame Street a new global home and, according to research from Ampere Analysis, the partnership marks its most strategic move yet in children’s entertainment — strengthening its family credentials while maintaining a much-loved family brand.

The streaming platform launches the new season on November 10th, along with over 90 hours of back episodes.

Key findings

Key findings

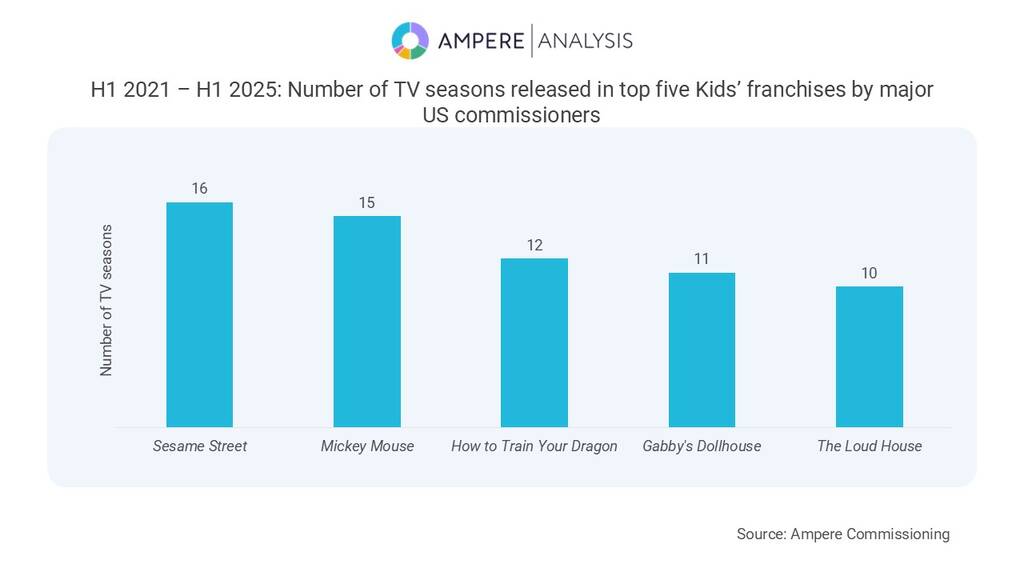

- Familiarity delivers audiences: In children’s entertainment, franchises, established content, and popular IP consistently capture audience attention. Between H1 2021 and H1 2025, major US commissioners1 released over 400 TV seasons of kids’ shows derived from franchises, amounting to 47 per cent of their Scripted Children & Family TV commissions, more than any other genre. Sesame Street topped the list of kids franchises with 16 new seasons – four from the original show and 12 spin-offs. Sesame Street on Netflix will drive this further.

- Shows built on established IP perform well in the kids space: Titles built on familiar IP appear consistently in the US Netflix daily Top 10 Kids’ Shows chart with high view counts, underlining how brand recognition and discoverability sustain audience engagement and loyalty. As a well-loved and highly recognisable brand, Sesame Street is likely to be a strong performer from this perspective.

- From YouTube to Netflix: To compete with long-established studios and TV networks, Netflix has previously relied on new media as a source of kids content hits. Some of the most viewed kids shows on Netflix (based on total season views) in 2025 first launched on YouTube: Cocomelon (83.1 million views), Ms Rachel (53.4 million views), and Bebefinn (29.9 million views). However, by acquiring such a longstanding TV brand in Sesame Street, Netflix is further establishing itself as a trusted mainstay of the TV market, akin to the networks it competes with, especially in the view of parents with young children.

- Retention opportunity: Although Cocomelon viewership has eased over time, it still ranks among Netflix’s top 10 shows across all genres. With Cocomelon leaving for Disney+ in 2027, Sesame Street could help Netflix fill a key gap and sustain engagement in the preschool segment.

Christen Tamisin, Senior Analyst at Ampere Analysis, commented: “Franchises play an important role in the Children and Family genre because brand recognition not only helps build awareness for upcoming titles, but it also creates a sense of trust in the quality of the content – crucial for parents. Netflix recognises this and draws upon both established IPs and franchises while introducing new popular content from YouTube. The iconic franchise Sesame Street will be a welcome addition to the Netflix catalogue, providing quality programming for a key demographic with a high likelihood of engagement. The battle for kids’ attention is definitely on.”

Other posts by :

- SpaceX launches 600th rocket

- Starlink: 10m customers and counting

- SES predicts end of ‘big’ Geo satellites

- Amazon Leo gets approval for 4,504 extra satellites

- SpaceX gets a portion of India

- TerreStar wants to build LEO network

- Musk: “No Starlink phone”

- Russia accused of eavesdropping on satellites

- FCC welcomes Musk’s 1m satellite plan